A wealth fund run by the royal family of Saudi Arabia has netted nearly $1 billion in profit after selling its stake in Live Nation Entertainment (NYSE: LYV). The Public Investment Fund (PIF) had purchased a significant stake in the entertainment giant and Ticketmaster parent in the spring of 2020, and has reportedly more than tripled its investment by getting out following a strong recent rally.

According to documents filed with the Securities and Exchange Commission, the PIF has fully liquidated its position in LYV, having completed the sales by the end of September. PIF purchased 12.34 million shares of LYV in April of 2020, which made it the third-largest shareholder in the entertainment giant at the time, at roughly 5.7 percent. It purchased those shares at a time where the stock had plummeted to below $40/share due to the sudden halt on live events brought on by the COVID-19 pandemic.

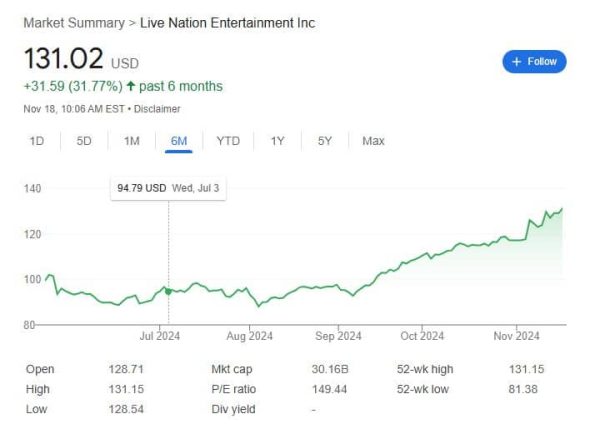

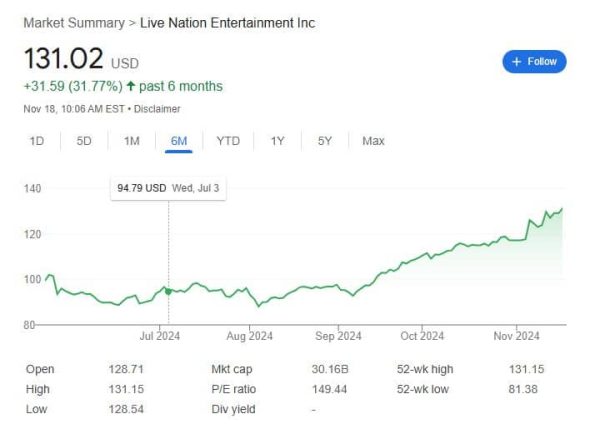

The return of live events, coupled with soaring revenue (fueled by business practices that have drawn an antitrust lawsuit filed by the Department of Justice and a majority of state Attorneys General seeking to break it and Ticketmaster up) has sent LYV stock through the roof. It had rebounded from its pandemic low point by early in 2021, then rising as high as $120/share by later in that year. It dipped after several notable scandals (Astroworld and the increased condemnation from lawmakers and regulators in the wake of the disastrously botched Taylor Swift Eras Tour ticket sales process being particularly notable), but has been red-hot of late, rocketing up by more than 30% since early September to all-time highs above $130/share.

Based on the recent filings, it is believed that the PIF sold its stake at a per-share price of around $109.49 in September, with a final value of approximately $1.39 billion, which would mean a profit of approximately $930 million for the Saudi fund, which is run by Crown Prince Mohammad bin Salman.

Liberty Media, which has been Live Nation’s largest shareholder for a number of years, has announced its own plans to spin off its LYV holdings into a new “Liberty Live” group. This will include the company’s 69.65 million shares in Live Nation as well as its recently-acquired 90 percent stake in Quint – a “world-class fan experience and corporate client entertainment activities” business based in Colorado.

Despite the share prices soaring, there remains significant peril for Live Nation Entertainment and Ticketmaster. Its entire business model has been accused of violating antitrust law, and the Department of Justice lawsuit has a broad, bipartisan array of Attorneys General supporting it. While company executives like Joe Berchtold have shown optimism that the incoming Trump administration will go easier on Ticketmaster and its parent than than the Biden Administration has, consumer advocates have expressed confidence that reigning in the company’s overwhelming dominance is too broadly supported by both consumers and lawmakers to be set aside by a more “traditionalist” agenda regarding business oversight.

Read More | Live Nation Execs Hope Trump Win Spells Doom for Antitrust Case |

| What They’re Saying” State Attorneys General Statements on the Live Nation-Ticketmaster Antitrust Lawsuit |

“DOJ’s case against Live Nation stands a good chance of surviving a transition in administration intact,” Diana Moss of the Progressive Policy Institute told TicketNews shortly before the November election. “This contrasts with the other digital tech monopolization cases on deck at the anti-trust agencies. Live Nation’s demonstrated anticompetitive practices present more familiar territory for the courts in terms of bringing strong theory and facts, so a win is likely and that looks good politically.

“Moreover,” Moss continued, “fan and artist outrage over high fees and no choice in ticketing would be hard for any administration to ignore.”